What Landlords Need to Know When Market Crashes

British governments don't deliberately exercise things that negatively touch house prices. Instead, the booms that they have bolstered have unremarkably inflated prices. Nosotros tend not to retrieve about the long term problem this creates. But we should reflect on it, because regime actions that button prices higher brand falls (rather than stability) more likely in the long term.

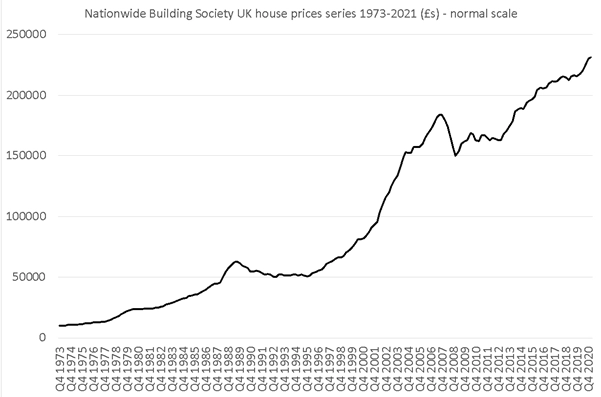

The British public today believes that house toll falls are very unlikely. The last time there was a sustained drop in house prices over a period of as long as four years was afterwards September 1989. That is such a long time ago that few people retrieve it.

Indeed, few adults today know that the average Britain house price did not return to its fall 1989 level until 1998 – almost nine years later!

The superficial reason for the fall in business firm prices later 1989 was 'overheating' in the UK, accelerated by a rush among some home-buyers to purchase property earlier a particular form of tax relief for couples (MIRAS) was withdrawn past the government. It was a very British house cost crash.

In contrast to 1989, the falls that came with the global financial crisis of 2008 are today better known and remembered.

In the UK, prices fell from a high boilerplate toll of £184,000 in tardily 2007, to a low of just nether £150,000 in early 2009. They did non return to the college level until mid-2014. Nevertheless, this was a faster 'recovery' than in 1989.

More chiefly, the cause of the falls in 2008 was viewed as both external and unlikely to be repeated considering – then information technology was said – the world would 'learn the lessons' of the cyberbanking crash.

Why do house prices matter politically? It may exist coincidental but both the ending of 18 years of Conservative dominion (1979-1997) and of 13 years of New Labour rule (1997-2010) occurred in the aftermath, or midst of, house price falls.

The current Britain government and the previous coalition which they dominated take so far been in ability for 'only' xi years (2010-2021). The current government's period in office might come to an cease without a fall in firm prices; or there could be a fall in firm prices and its rule might not end there.

Still, if at that place were a driblet (which would probably be described as a crash if it were anything but minimal) the Conservatives would be in problem. It might too exist foolhardy to ignore the touch on of even a slight future fall given how important firm prices are now to many people'south sense of how well-off they are – and to their sense of wellbeing.

It is no coincidence that support for the Conservative party is highest in areas where house prices are loftier and where a high proportion of people own their home or have a mortgage.

"It is no coincidence that support for the Bourgeois party is highest in areas where house prices are high and where a high proportion of people own their home or have a mortgage."

For a very big and growing number of people, of course, increasingly loftier prices are the bane of their lives, forcing them to hire privately well into middle age and preventing them from being able to relieve considering rents are so exorbitant.

The very loftier house price differentials beyond the UK also hinder geographical mobility, which in turn hinders social mobility.

Equally I write in 2021, we seem to have forgotten that business firm prices tin can autumn, and they can autumn without an external international trigger. Many people now shrug off the idea of firm prices reducing evenly slightly in the UK.

Later on all (they might say) a global pandemic came and they did non fall: so if fifty-fifty Covid-xix can't dent the rise in the cost of ownership a United kingdom of great britain and northern ireland dwelling house possibly nothing tin?

But at some point (and nosotros can't know when) business firm prices will eventually stop rising and start falling in real terms. For the Uk this could exist a very long fourth dimension in the future. Scenarios can be modelled where they practise not autumn for decades.

Alternatively, this event could happen in a few months' time. Only eventually business firm prices e'er exercise drop afterward reaching a peak. Furthermore, that autumn need non exist short-lived or slight; it could exist substantial and enduring.

How practice governments keep firm prices high?

Rising business firm prices have been seen as politically advantageous by all governments since the 1980s. Home-owners have seen it every bit evidence of both good national economic management and of their own individual success.

In contrast, in periods when house prices were falling – 1989-1993 and 2008-2011 – public conviction in government was far lower. John Major never really regained that conviction despite winning the 1992 general election; and the Coalition government that won in 2010 used the memory of the falls from 2008 onwards to successfully paint the Labour party as economically incompetent.

Nosotros should not underestimate merely how important it has been for UK governments to keep house prices high and, if possible, rising; or at least to try to steady and quickly reverse whatsoever fall. The New Labour government did this in 2009-ten past diverting £1 billion from what had been their regional economic programs to support the housing market.

This included 'HomeBuy Straight' – loans of up to 30% on a new-build, interest free for the first five years, for first time buyers. Since so, various versions of 'Assistance to Buy' have been used to prop up prices at the bottom of the market if they e'er wait to exist in danger of falling.

The Help to Purchase schemes we have seen since 2009 accept not been intended to make housing costs cheaper for 'the many'. To lower housing costs requires, among much else, ii things to happen in the rental sectors.

First, ensuring plenty good quality social housing is available to prevent private sector rents ascension rapidly: inadequate social housing provision ensures a limited rental supply. This then encourages people with access to a lot of coin to buy up family unit homes and rent them profitably on the private rental market – thereby preventing families from buying those homes.

2d, renting in the individual sector must be fabricated secure plenty that families do non experience compelled to buy for fear of being evicted from their abode should their landlord desire to sell or raise the rent. If this has the result of deterring people from becoming private landlords, so that would also aid increment affordability for those who desire to buy the abode they live in.

When in opposition in 2015, 2017, and 2019 the Labour party talked about some of these options. In item, Labour suggested introducing meliorate rent regulations. Merely that party has not yet dared suggest that house prices are besides high – and when they were in power they did nothing to assistance renters.

In contrast to Labour, the Conservatives do non fifty-fifty seriously hash out making renting less precarious and expensive.

Instead, they prefer to talk about how schemes such every bit 'shared ownership' might permit someone to get role of a foot on the lowest rung of a ladder. When information technology comes to action, autonomously from the huge financial delivery of introducing 'Help to Buy' schemes, their main endeavour has been to tinker in guild to enhance prices further.

In recent years, stamp duty cuts have increased Britain firm prices past reducing the costs to buyers – encouraging sellers to increment their asking prices. Just what might they practise if the current very loftier prices lead to a loss of sentiment in the marketplace and a slump in buying?

When the 2008 crash hit, the New Labour government introduced the Mortgage Rescue Scheme (MRS) for homeowners with a mortgage who were unable to sell but likewise unable to go along upwards payment on their mortgage due to changed personal circumstances.

Mortgagees could ask for help in reducing their repayments to their bank or building society. Even so, if those repayments were considered by government to be unsustainable, so a housing association would be permitted to purchase and rent back the property to the borrower on a iii-year assured shorthold tenancy at 80% of the market rent (or purchase with shared ownership if there was some disinterestedness in the property).

In 2008 the government besides introduced Homeowners Mortgage Support (HMS), whereby the state would underwrite upwards to 80% of the losses of a bank or building society that showed some leniency to a mortgage holder unable to pay their full mortgage due to a fall in income.

At the time, the belief was that MRS could be taken up by upward to 6,000 borrowers, while a lender-led assessment estimated that HMS could directly support up to 42,000 borrowers.

In the effect, the numbers of families resorting to these schemes was much lower, although it is idea that their existence helped deter banks and building societies from repossessing properties at the rates seen after the 1989 crash.

Thus it was New Labour, just earlier they left function, that first instigated policies to attempt to ensure that when business firm prices did fall, they did not fall far. This included pledging government funds to underwrite potential private sector banking losses in the event of any price fall, and then encourage banks to keep on lending.

The intention of New Labour'south 2008 and 2009 housing policies may have been partly to assist families that might otherwise have found themselves homeless, but information technology was not only that. It also set a precedent for the Britain government to arbitrate significantly in the individual housing marketplace to ensure that prices did not fall, or only ever fell past a small amount.

The showtime 'Help to Buy' housing loans were issued past the Coalition government in 2013. The previous schemes, HomeBuy Direct, MRS and HRS together helped a modest number of families (around fifteen,000 across the three schemes).

In contrast, a huge number of people, living in 280,000 households, had had their purchase of a domicile underwritten with 'Aid to Buy' by summer 2020. In 2021 a new scheme was introduced under which the government will lend upwards to £25 billion directly to home buyers – the expectation being that this whole sum would be loaned by 2023.

Yet, even before the UK regime began to spend that £25 billion, prices began to rise even more quickly than before in 2020 and 2021. Then, too, did sales, rise to nigh 140,000 a calendar month by belatedly spring 2021. Covid-19 has, of course, had its ain impact on the housing market. It is often said that the pandemic has increased the demand for larger properties in more rural areas. Yet, this is questionable.

"Covid-19 has, of course, had its ain impact on the housing market. It is often said that the pandemic has increased the need for larger properties in more rural areas. However, this is questionable."

Instead the deplorable reality is that it may have resulted in an unusually large number of such properties coming onto the marketplace and then altering the mix of those that were sold very recently. The large majority of people who died in the pandemic were elderly, leading to an unusually large number of backdrop beingness put on the marketplace when their occupants died.

This in plow altered the balance of what was being bought and sold during tardily 2020 and early on 2021, changing the mix of housing transactions. That so resulted in prices appearing to ascent faster as the reported prices were not 'mix-adjusted'.

And that, in plough, boosted conviction amongst sellers to ask higher and higher prices. The headlines in June 2021 simply suggested a 'race for space', not how the infinite became bachelor (see Table below)

Table: The Housing News on Tuesday ane June 2021

Financial Times: (Valentina Romei): 'UK house prices rising at fastest charge per unit since 2014:

Growth in May surpasses expectations driven by stamp duty holiday and need for larger properties. The boilerplate firm cost grew by 10.9 per cent compared with May last yr…'

Telegraph (Rachel Mortimer): 'UK house prices fasten 11pc despite looming taxation rise:

Surging value will continue even when stamp duty increases, experts say as properties bound at fastest pace for seven years. House prices rose 10.9pc in the 12 months to May with double-digit increases expected to go on well into the summer…'

This is Money (Ed Magnus): 'House prices will nail earlier crashing in 2026: We speak to the man who forecast the last ii slumps, but will his eighteen-year property cycle exist right again?'

BBC (unnamed journalist): 'Business firm prices jump 10.ix% equally 'race for space' intensifies… England, Northern Ireland and Wales extended relief to the finish of June. After that in England and Northern Ireland, the zip rate ring will be set at £250,000 – double its standard £125,000 level – until the cease of September.'

The Guardian (unnamed journalist): '…But Guy Harrington, CEO of residential lender Glenhawk, predicts that the stride of growth volition slow, especially if a third wave of Covid-19 cases hits the UK. "The disconnect between the U.k. housing market and economic reality appears equally corking as ever. Government stimulus has created a faux sense of consumer confidence."'

Sky News (Ed Clowes): 'House prices soar 10.9% to vii-yr high in 'race for space'. A buying frenzy in the wake of the pandemic has driven house prices to a about-seven year high, amid warnings activity could stall.'

Bloomberg (David Goodman and Marc Daniel Davies): '"It is shifting housing preferences which is standing to drive action, with people reassessing their needs in the wake of the pandemic," said Robert Gardner, chief economist for Nationwide. "Given that only around 5% of the housing stock typically changes hands in a given yr, information technology only requires a relatively small proportion of people to follow through on this to take a material touch."

The Independent (Ben Chapman): 'Great britain house prices 10.ix% higher in May than a year earlier on boilerplate… Anna Clare Harper, CEO of asset manager SPI Capital, said: "Some will encounter 10.9% annual growth in the year to May equally a boom, to exist followed shortly by a bosom, but what tends to happen in the housing market place is different from other purchases and investments.."'

Manor Agent Today (Graham Norwood): 'Tidal Wave: some house prices upwardly as much as 48 per cent in a yr'

The Express (Emily Hodgkin): 'Property boom: The town where house prices have risen 48 percent in a yr… House prices have surged in St Mawes in the South West by 48 percent. The area, in Cornwall, has seen average prices bound to over half a million pounds. The average house prices take jumped from £339,912 to £501,638.'

Stoke on Trent Live (Hayley Parker): 'House prices across Stoke-on-Trent and Staffordshire heaven rocket through lockdown… Beyond the UK, firm values have been ascent at their fastest pace since Baronial 2008, and Stafford has seen prices rocket by the most locally in the past year.'

Who loses when prices tumble?

So, to come back to the question this piece began with: who really suffers when firm prices autumn?

Landlords endure as the value of their assets falls. New first-time buyers benefit, if buying later on the fall, which should help some tenants. That in turn should reduce the demand to rent, reducing rents a fiddling. Home-buyers who have just begun a mortgage lose out, as they might stop up with negative equity. The government also loses out, as it has underwritten so many loans. Dwelling-buyers who ain outright or who have paid off a meaning office of their mortgage do not suffer directly; but those looking to inherit from them might.

In April 2020, the Institute for Fiscal Studies produced a written report estimating the expected variation in lifetime inherited income of households.

Someone born in the 1980s into the all-time-off 5th of households can await to boost their full household lifetime income by xxx% from inheritances, mainly from parents and grandparents. These anticipated inheritances are larger than for previous generations and mainly the effect of housing gains. Information technology is hardly surprising that so many people are obsessed by house prices given what this effigy shows.

Only just as governments announced to give many people money when house prices rising, so information technology will announced to many that that money has been taken abroad if prices are allowed to autumn to the detriment of those expected inheritances.

Figure 2: Median inheritance equally a percentage of lifetime (excluding inheritance) internet income, by parental wealth quintile and decade of birth

Source: https://www.ifs.org.uk/publications/15407 Pascale Bourquin, Robert Joyce and David Sturrock

It is very hard to predict what the wider reaction to a fall in prices might be because, until recently, inheritances from housing were so much smaller.

Many people built-in in the 1960s are yet to inherit. Those born in before decades on boilerplate inherited far less equally a proportion of their lifetime income. The implication is that the time to come effect on political sentiment of any house toll falls could exist much higher than in the by because many more people are at present cyberbanking on it holding or increasing its value.

Politicians are very much alive to these problems. Government ministers and MPs often own more than i home, partly considering of the necessity to have a base in London. A high proportion are likewise landlords. They volition not exist unaware of the importance of housing for their own and their children'south plans.

So, while they may talk of wanting to make housing more than affordable, they may also realise that doing so could be politically and personally disastrous for them and their children.

"So, while they may talk of wanting to brand housing more affordable, they may as well realise that doing so could be politically and personally disastrous for them and their children."

Politicians cannot say that they are content with the condition quo, then they most often talk most firm edifice every bit the solution to the affordability crisis. However, as long as the social distribution of dwelling ownership remains then uneven; equally long as an ever-growing proportion of holding is endemic past landlords and by people who have second homes; and as long every bit a significant and growing proportion of property is at least partially unoccupied, then it does not matter how much more than is congenital.

Prices practice non autumn when more is built – peculiarly when they are propped up by so much authorities policy to forestall them from falling. All of this racks up the stakes, making housing more than and more unaffordable to the majority who have to live somewhere. Increasingly this is in their parents' homes because younger adults tin but afford to leave the family nest later in life.

The political implications of firm price falls

When house prices in the U.k. somewhen fall, we are likely to ascribe that to a detail event, such as a autumn in need from the immature adult population as a result of migration patterns altered past Brexit; or a alter in demand abroad from metropolis locations as a consequence of Covid-19.

Whatever the reason, we should call up that governments were actively forcing prices higher and higher in the first place. And so when the fall comes, remember it was e'er going to happen and the trigger of the moment will not be crucial but casual. What though will happen politically when the autumn happens?

"And then when the fall comes, recall information technology was always going to happen and the trigger of the moment will non exist crucial but coincidental. What though will happen politically when the fall happens?"

In the 1992 general election, the Conservative vote fell more in areas where home-buyers were experiencing negative disinterestedness than anywhere else. This was not enough to ensure that the Bourgeois party lost that election. But the damage done to the confidence of Conservative voters contributed to some degree to the huge defeat the political party suffered in 1997.

UK governments, and virtually obviously Conservative governments, try to prop up business firm prices because they are scared of the political implications of allowing them to fall.

For ordinary people 'the economy' means jobs, wages, the consumer cost index and especially house prices. In the 2019 general election, 86% of Conservative seats had higher up boilerplate home ownership, compared to 82% of Liberal Democrat seats and only 26% of Labour seats.

It is likely that there will come a moment when prices will fall regardless of what a authorities does. In September 1989 it was the ending of that tax loophole called 'MIRAS for couples'. Merely information technology could be annihilation that does it.

For example, any government increasing social protection for tenants of private landlords could adventure introducing the mensurate that triggers this fall – which might partly explain why the current government does not implement better rights for tenants.

Another possible trigger could be the effect of Brexit reducing in migration, having other harmful economic consequences and reducing housing demand.

One time prices kickoff to drop, confidence in the market can fall even faster. People might hold off from buying a house. Banks may become very wary of lending to landlords to buy more property and brainstorm to worry almost their balance sheets. At the farthermost, a burn-sale may begin. That occurred in Nihon in the early on 1990s. In 2005 house prices in some parts of Tokyo were still only half what they had been in 1991!

What happens next, is extremely uncertain, even if the price falls are only small. Peoples' dreams brainstorm to be dashed. Affluent couples dream of trying to buy a abode only to notice that sellers are non willing to have the new, lower, market place value. Tenants dream that their child does not have to motility schoolhouse only to find that their landlord is of a sudden forced to evict them in order to reduce their property portfolio.

But the largest thwarting will exist for people who thought that the property their parents owned, or that they had only recently bought, would be worth a given sum.

We only have a few examples of falling prices in the past, and each scenario is unique. But the large deviation next time will be that the dashing of futurity inheritance gains for many individuals will be far greater.

A future government might seek to blame pessimists in opposition parties for the autumn; or if in that location has been a recent alter in regime, it could blame the previous administration and its policies.

I contempo commentator suggested that interest rate rises in hereafter might slow cost rises concluding that '[thousand]aybe rates volition ascent slightly over that time, but non by plenty to trigger a housing crash. That cannot be immune to happen: the economy and Tory politics say and then.' All the same, that assumes that the marketplace can be managed.

At times the market has a mind of its ain.

Determination

The social divisions of Britain, with the widest income inequalities in all of Europe (apart occasionally from Republic of bulgaria!), are most clearly divers by housing.

Countries in Europe with much more equal income distributions tend to have far better housing policies and amend housing outcomes. In an odd manner, information technology may non be the banking crash of 2008, or Brexit, or Covid-19, that will accept the most enduring impact on Britain this century. It may nevertheless be the business firm price falls to come up.

What else could drastically reduce our regional economical divides, which are also amidst the widest in Europe? The current government's 'levelling up' agenda is little more than a cosmetic practice with hints of pork-barrel politics.

"The current regime'south 'levelling upwards' calendar is little more than a cosmetic exercise with hints of pork-butt politics."

Finally, consider again the graph this article began with, only now re-drawn using a logarithmic scale. That calibration ensures that equal pct changes are represented equally on the vertical axis of the graph. The peaks and troughs are identical to the offset graph shown to a higher place, of class, simply the gradient of the toll curve is different to that previous graph.

On a log calibration, a doubling of prices appears equally an identical increase regardless of the bodily prices. Looked at in this manner, rises in housing prices take been slowing downward over the entire 1973-2021 period.

The graph is steepest in the tardily 1970s, when full general inflation was as well very loftier. Then again in the 10 years from 1980 to 1990, when prices increased by 150% in that decade. Information technology took the 15 years to 2005 for prices to increase past 150% once more. In the sixteen years between 2005 and 2021 prices have 'only' risen by 50%, from £153,000 to £232,000.

What does this last graph portend? When business firm prices side by side stutter, or fall, or crash, the political implications may be fifty-fifty greater than they were in the years earlier the 1997 election and in the years earlier the 2010 election.

What may well be different next time is that they then never recover fully, and perhaps (at some point) might even non go along up with general inflation. Who would then buy property as a speculative brusk or medium term investment, rather than every bit a home?

What a different country the United kingdom of great britain and northern ireland might go. Perhaps a amend i.

Past Danny Dorling, Professor of Geography at the Academy of Oxford.

vitaglianothall1989.blogspot.com

Source: https://ukandeu.ac.uk/long-read/house-prices-crash/

0 Response to "What Landlords Need to Know When Market Crashes"

Post a Comment